Are State funds used as planned to promote education and healthcare? Can people and companies find out how tax revenues have been used? Are tax revenues used to pay the salaries of teachers, nurses and police officers?

It is the task of public financial administration to ensure that State funds are used efficiently and in compliance with the principles of good governance. People do not want to pay their taxes if they suspect that tax revenues are used inappropriately. Investors want to invest in countries where the State funds are used to build roads or expand the electricity network. Improving the performance of public financial administration is important for achieving development targets.

Finland is supporting the development of public financial administration and taxation in Tanzania, Kenya, Somalia and Afghanistan together with other donors. In Tanzania, for example, 90 per cent of the ministries achieved a satisfactory level in their financial administration in 2016. In Afghanistan, the ministries with the highest budgets were subject to auditing. The implementation of an act on public procurement was being promoted in Somalia. The goal is that most of the public procurements will be subject to competitive tendering by 2018. In Kenya, one in four citizens took part in discussions in 2016 about how the county funds should be used.

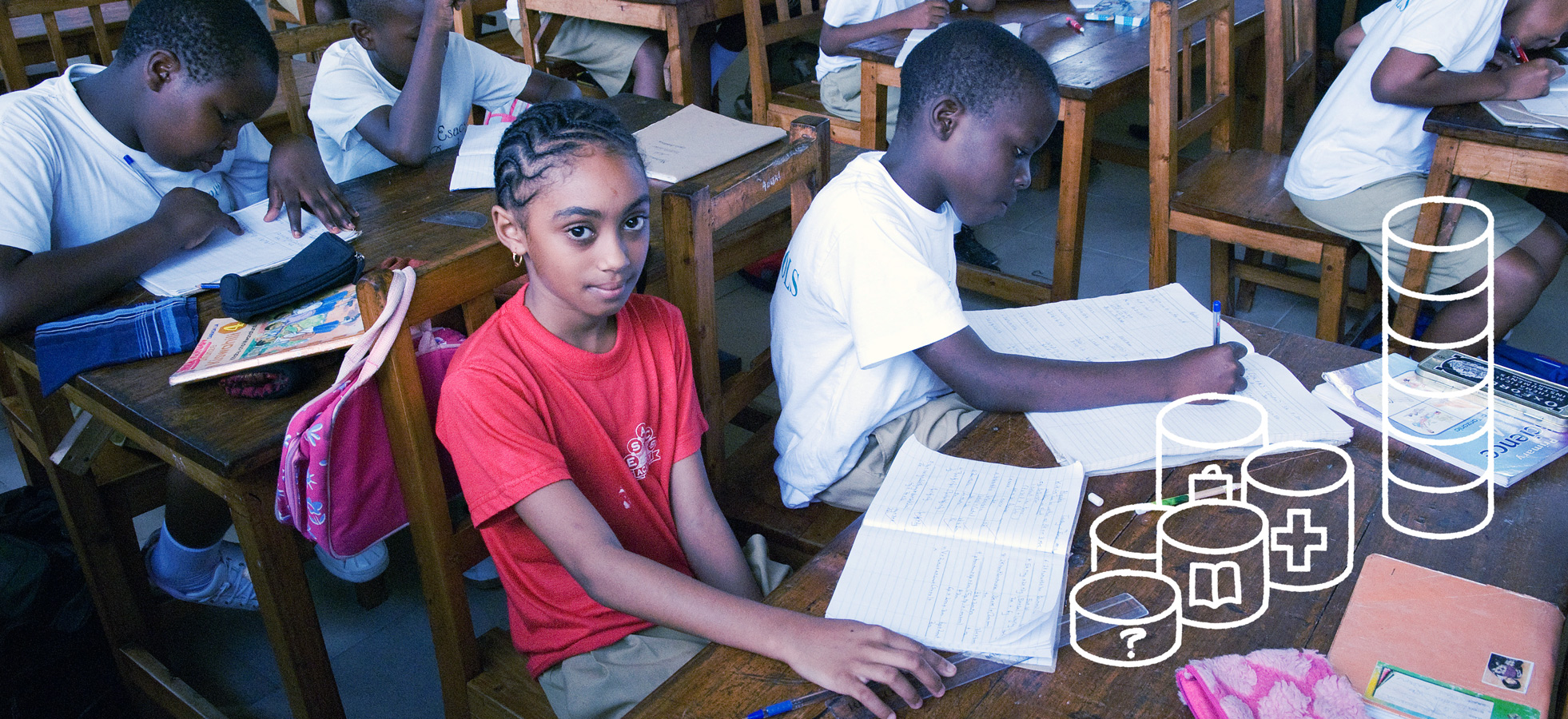

Photo: Tiina Kirkas, graphics: Juho Hiilivirta